(Graphic 1)

(Graphic 2)

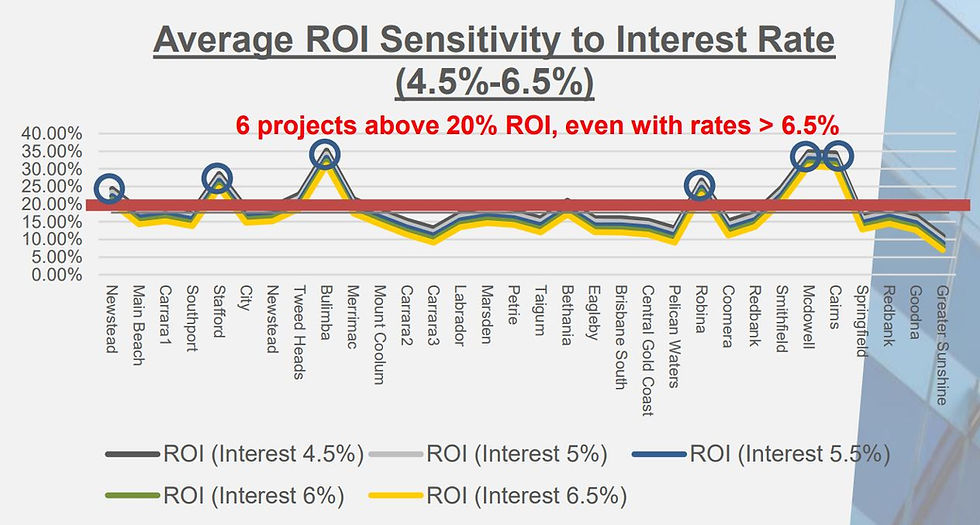

Interest Rates and ROI

So how do interest rates affect ROI with respect to management rights? Here we did a study (of current October listings of projects 2m - 5m Aud) by directly calculating the interest expense incurred from the approximate current average of 4.5% for management rights loans to an increase of 44% to 6.5%.

RBA implemented a 25-basis point rate hike early October, slowing down the rate of increase, but vowing to continue the increase to curb inflation. It is expected that by the end of the year, the cash rate will be at 3.1% from the current rate of 2.6%, an estimation of two rate hikes one in November of 25 basis points, and another in December of 25 basis points.

With cash rate at the end of the year possibly at 3.1%, its most likely that the borrowing rate for management rights will at least creep up by another 50 basis points to 5%. From the table (graphic 2), here we see that an increase from 4.5% to 6.5% in interest rates, is equivalent to a decrease in average ROI from 19.98% to 15.98%. Thus, the approximate sensitivity of the ROI is a 44% increase in interest rate is the equivalent of a 20% decrease in ROI. At an interest rate of 5%, the decrease in average ROI drops from 19.98% to 18.98%, so approximately a 5% decrease in ROI.

In graphic 1, we map the ROI of each individual project corresponding to changes in interest rates.

Upon analysis, of the 32 projects, we see that there are still 6 projects that return a possible 20%+ even with interest rates at 6.5%+. So as an example, these would be the prospective projects that our investment arm will conduct further due diligence on as prospects for acquisition.